30

Volume 42 Issue 2

oil Products

Crude Oil

Change from

October

2015

October

2015

November

2015

Change from

October

2015

October

2015

November

2015

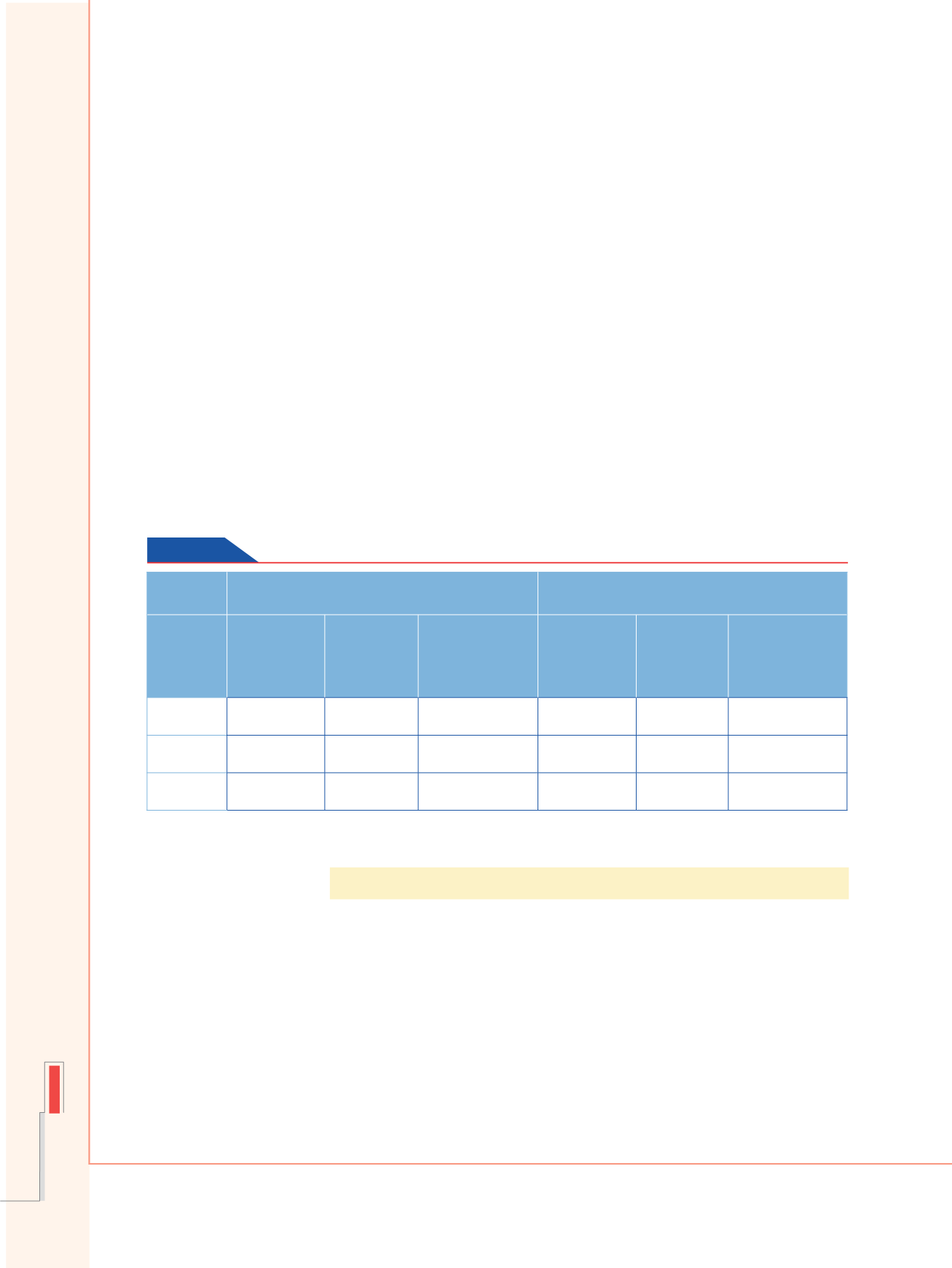

6.882

6.675

0.207

-2.287

-2.159

-0.128

USA

3.260

3.122

0.138

0.016

-0.023

0.039

Japan

6.592

6.222

0.370

-0.148

0.203

-0.351

China

Source: OPEC Monthly Oil Market Report, various issues 2015.

Table 4

USA, Japan and China Crude and Product Net Imports / Exports

( Million bbl/d)

China

In November 2015, China’s crude oil imports increased by 448 thousand

b/d or 7% to reach 6.7 million b/d, whereas China’s oil products imports

decreased by 107 thousand b/d or 10% to reach 978 thousand b/d.

On the export side, China’s crude oil exports reached 78 thousand b/d,

and China’s oil products exports increased by 244 thousand b/d or

27% to reach 1.1 million b/d. As a result, China’s net oil imports reached

6.4 million b/d, representing an increase of 0.3% comparing with the

previous month.

Russia was the big supplier of crude oil to China with 14% of total

China’s crude oil imports during the month, followed by Saudi Arabia with

13% and Angola with 9% .

Table (4)

shows changes in crude and oil products net imports/(exports)

in November 2015 versus the November month:

4. Oil Inventories

In November 2015,

OECD commercial oil inventories

remained

stable at the same previous month level of 2981 million barrels – a level

that is 246 million barrels higher than a year ago. It is worth mentioning

that during the month,

commercial crude inventories in OECD

decreased

by 8 million barrels to reach 1187 million barrels, whereas

commercial oil

products inventories

increased by 8 million barrels to reach 1794 million

barrels.

Commercial oil inventories in Americas

increased by 5 million

barrels to reach 1581 million barrels, of which 645 million barrels of crude

and 936 million barrels of oil products.

Commercial oil Inventories in