16

Volume 42 Issue 2

The downward trend of oil prices since

mid-2014 is still drawing the attention of many

experts in oil industry as the concerns about

its impacts on the entire global economy and

on the producing and consuming countries and

on the future of the oil industry as whole are

increasing. It’s worth noting that there is a great

similarity between the factors which affecting

the oil price today and its counterpart, which

prevailed during the mid- eighties crisis. There

was an increase in Non-OPEC oil supplies ,

especially from Alaska, Mexico and the North

Sea region, concurrent with the slowdown in

the growth in oil demand. OPEC countries, at

that time, have decided to address the situation

by cutting down their production in an effort to

restore stability in the oil market and to prevent

more collapsing in oil prices. That action led

to OPEC losing a significant share in the oil

market, as OPEC’s share fell from 42.6% in

1980 to only 27.2% in 1985.

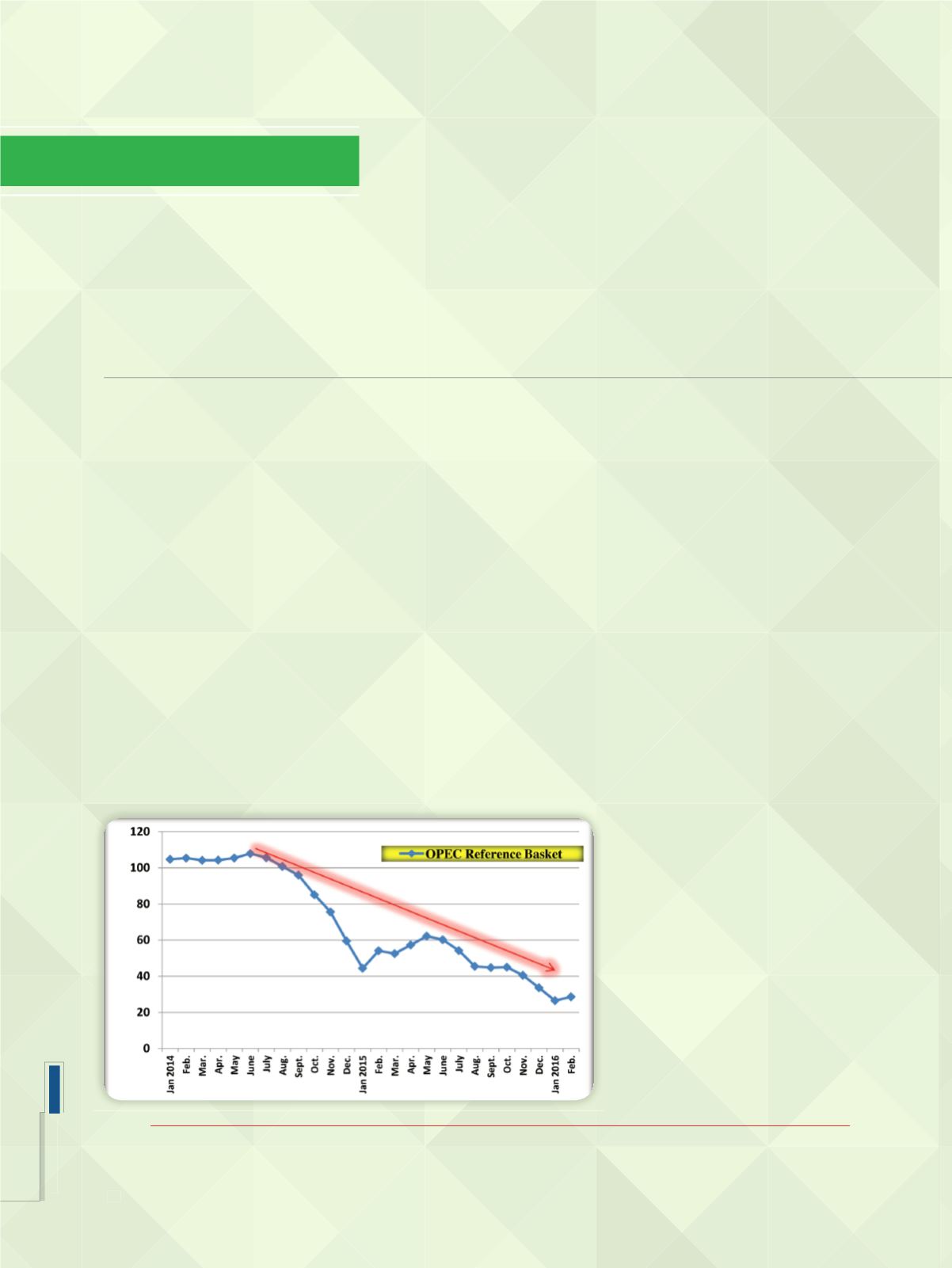

At present, oil prices fell from their highest

level of $107.9/b in July 2014 to their lowest

level of $ 26.5/b in January 2016, representing

a decline of $81.4/b or about 75%. It’s

noteworthy that this level was not seen since

September 2003, when prices then reached a

level of $ 26.3/b.

Many factors have contributed in one way

or another in the decline in oil prices, on top

of that is the oversupply of crude oil which

prevailed throughout the year 2015 and the

beginning of 2016. The oil market has recently

been characterized by the surplus in oil supply

which reached about 2.1 million b/d in the first

quarter of 2015, 2.7 million b/d in the second

quarter, and 1.7 million b/d in the third and

fourth quarters. The surplus in

January 2016 has reached 2.5

million b/d.

It is worth mentioning that

the surplus in oil supply in

2015 has mainly came as a

result of the increase in Non-

OPEC oil supply. About 70%

of the increase in Non-OPEC

oil supplies came from the

United States especially from

the shale oil, and the remaining

(30%) was divided between the

Canadian tar sands, deep water

oil from Brazil and the increase

Oversupply of Oil and Its

Impact on Oil Prices

ABDULFATTAH DANDI

Director of Economics Department- OAPEC

Point of View

* The contents of this article are the author’s sole responsibility. They do not necessarily represent the views of OAPEC or any of its members.