Volume

44

Issue

2

27

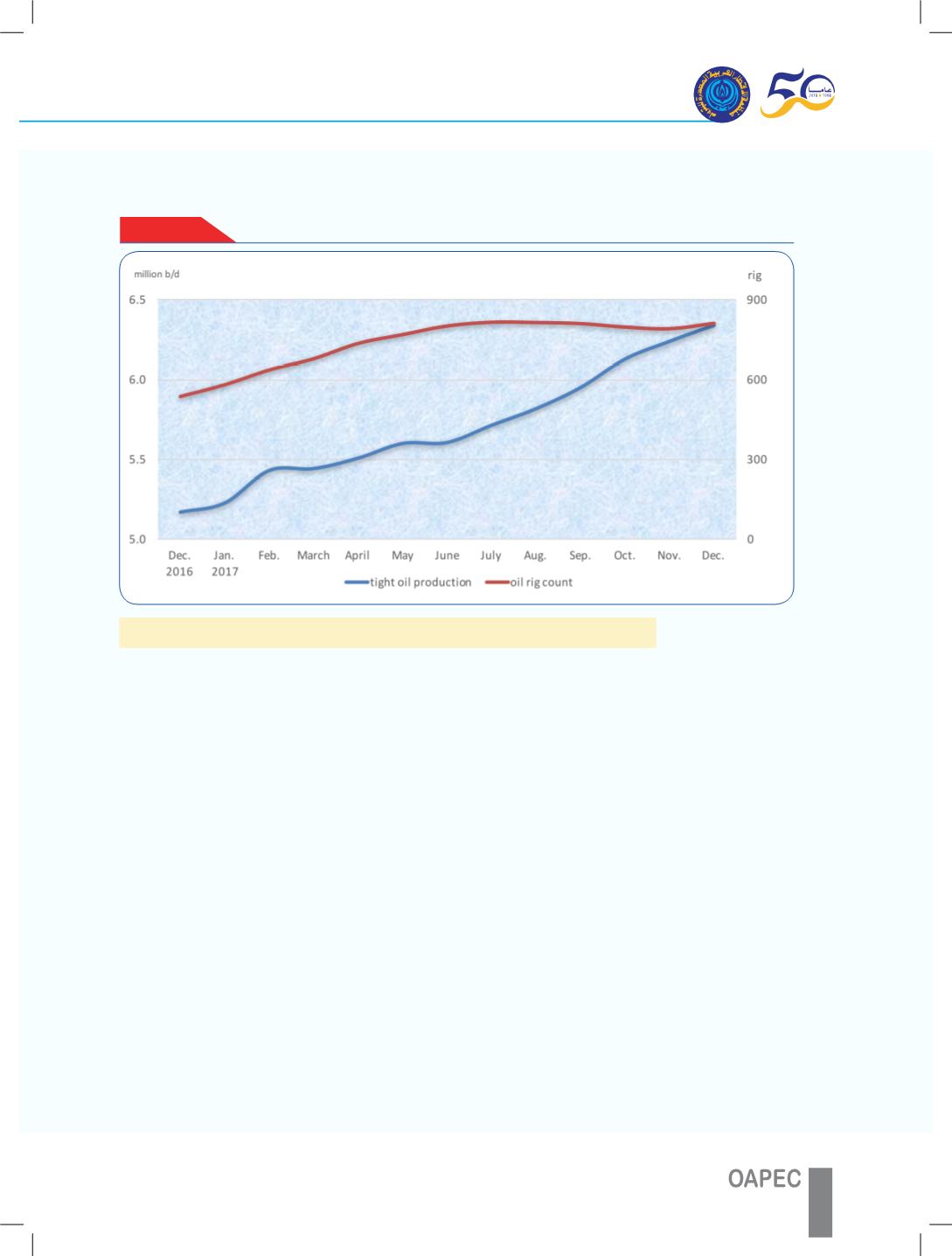

Figure - 7

US tight oil production and oil rig count

3.Oil Trade

USA

In November 2017, US crude oil imports decreased by 79 thousand b/d or 1%

comparing with the previous month level to reach 7.6 million b/d. And US oil products

imports decreased by 56 thousand b/d or 2.7% to reach about 2 million b/d.

On the export side, US crude oil exports decreased by 531 thousand b/d or

29.8% comparing with the previous month level to reach 1.3 million b/d, whereas

US products exports increased by 82 thousand b/d or 1.6% to reach 5.3 million b/d.

As a result, US net oil imports in November 2017 were 314 thousand b/d or nearly

11.6% higher than the previous month, averaging 3 million b/d.

Canada remained the main supplier of crude oil to the US with 44% of total US

crude oil imports during the month, followed by Iraq with 9%, then Mexico with 8%.

OPEC Member Countries supplied 38% of total US crude oil imports.

Japan

In November 2017, Japan’s crude oil imports increased by 398 thousand b/d or 14%

comparing with the previous month to reach 3.3 million b/d. And Japan oil products

imports increased by 55 thousand b/d or 10% comparing with the previous month to

reach 612 thousand b/d.

On the export side, Japan’s oil products exports increased in November 2017, by 163

thousand b/d or 40% comparing with the previous month, averaging 573 thousand b/d.

As a result, Japan’s net oil imports in November 2017 increased by 290 thousand b/d or

9.4% to reach 3.4 million b/d.

Saudi Arabia was the big supplier of crude oil to Japan with a share of 42% of total

Japan crude oil imports, followed by UAE with 25% and Qatar with 8% of total Japan

crude oil imports.